Trustee Excellence Unveiled: Leveraging the Know-how of an Offshore Trustee

Wiki Article

Open the Conveniences: Offshore Trust Fund Services Clarified by an Offshore Trustee

Offshore trust solutions have ended up being significantly preferred amongst individuals and businesses looking for to optimize their monetary methods. From the essentials of offshore counts on to the details of tax planning and possession protection, this overview discovers the numerous advantages they offer, consisting of boosted privacy and confidentiality, adaptability and control in riches monitoring, and accessibility to worldwide financial investment chances.The Fundamentals of Offshore Counts On

The basics of overseas trust funds include the establishment and management of a depend on in a jurisdiction outside of one's home country. Offshore depends on are commonly used for property defense, estate preparation, and tax obligation optimization functions. By placing properties in a count on located in a foreign jurisdiction, people can guarantee their assets are secured from possible threats and obligations in their home country.Establishing an overseas trust generally calls for engaging the solutions of a professional trustee or trust fund business who is fluent in the legislations and guidelines of the selected territory. The trustee acts as the lawful proprietor of the properties held in the trust while managing them in conformity with the terms established out in the trust fund action. offshore trustee. This plan gives an included layer of defense for the assets, as they are held by an independent 3rd party

Offshore trusts offer numerous benefits. Offshore trust funds can facilitate reliable estate planning, enabling people to pass on their riches to future generations while reducing inheritance tax responsibilities.

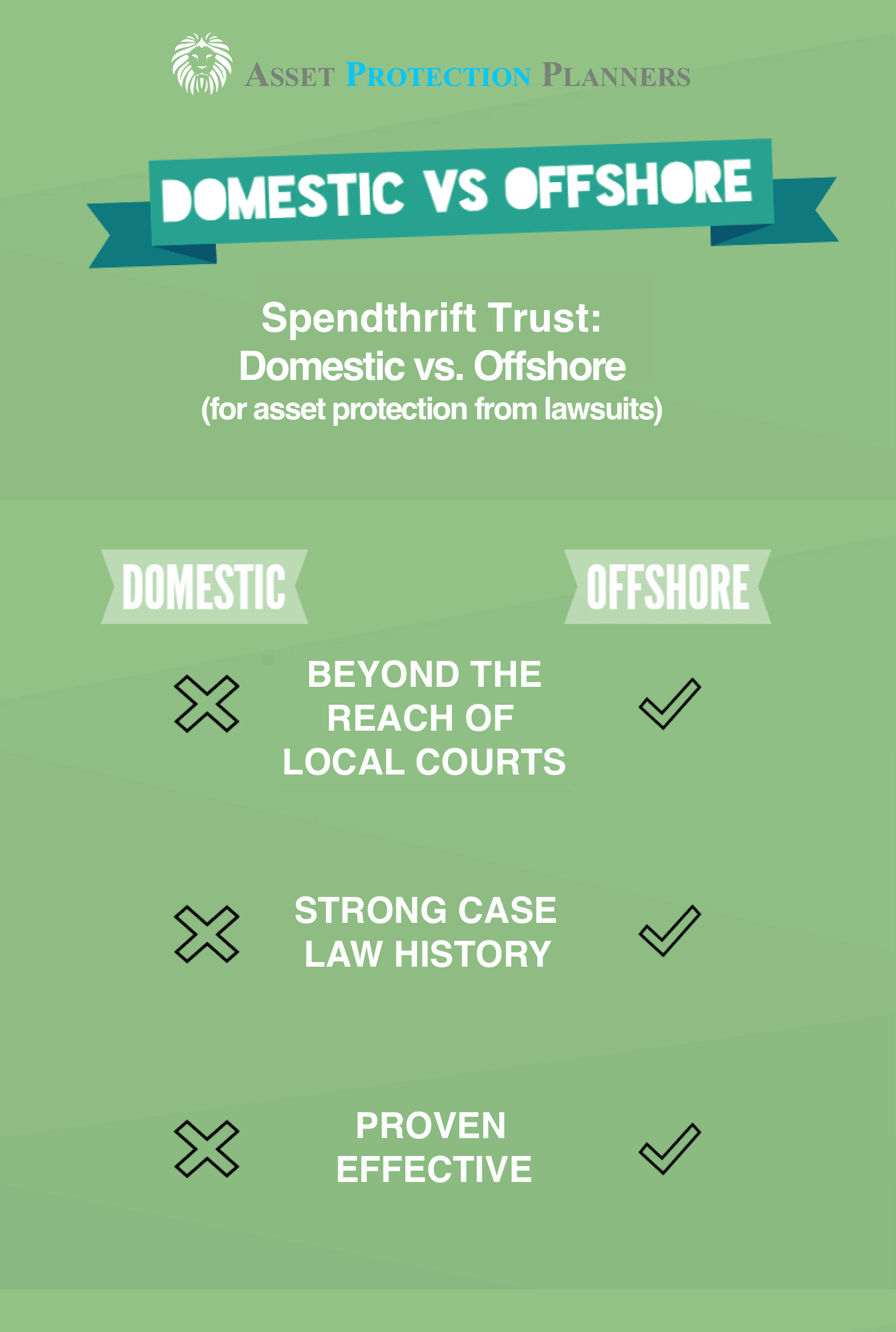

Tax Obligation Preparation and Property Protection

Tax preparation and possession defense play a critical function in the tactical application of offshore trusts. Offshore counts on supply individuals and services with the opportunity to minimize their tax obligation responsibilities legally while securing their properties.By moving possessions right into an overseas trust, people can protect their wealth from potential legal claims and guarantee its preservation for future generations. Furthermore, offshore trust funds can supply privacy and personal privacy, further securing assets from prying eyes.

Nevertheless, it is necessary to note that tax obligation planning and property defense ought to constantly be conducted within the bounds of the legislation. Involving in unlawful tax evasion or deceptive possession security methods can cause serious consequences, consisting of fines, charges, and damages to one's reputation. Therefore, it is necessary to look for professional recommendations from knowledgeable overseas trustees who can guide individuals and businesses in structuring their overseas count on a honest and compliant fashion.

Improved Privacy and Privacy

Enhancing privacy and confidentiality is a critical purpose when making use of overseas trust solutions. Offshore counts on are renowned for the high degree of privacy and confidentiality they use, making them an eye-catching alternative for businesses and people looking for to safeguard their assets and economic details. Among the key advantages of offshore trust fund services is that they give a lawful framework that enables individuals to keep their monetary affairs private and shielded from spying eyes.

The enhanced personal privacy and discretion offered by overseas trusts can be specifically beneficial for people who value their personal privacy, such as high-net-worth individuals, stars, and specialists seeking to protect their properties from possible lawsuits, financial institutions, and even household conflicts. By making use of overseas trust fund solutions, people can maintain a higher degree of privacy and discretion, permitting them to safeguard their wide range and financial interests.

Nevertheless, it is check my blog important to keep in mind that while overseas trusts use improved personal privacy and privacy, they should still abide by applicable laws and laws, consisting of anti-money laundering and tax reporting requirements - offshore trustee. It is vital to function with trustworthy and experienced lawful professionals and overseas trustees that can ensure that all legal obligations are fulfilled while taking full advantage of the privacy and discretion advantages of offshore trust fund solutions

Flexibility and Control in Riches Administration

Offshore trust funds supply a significant degree of versatility and control in riches monitoring, allowing individuals and businesses to effectively manage their possessions while maintaining privacy and discretion. Among the essential benefits of overseas trust funds is the capacity to customize the trust framework to fulfill specific needs and goals. Unlike traditional onshore trusts, offshore counts on offer a large range of choices for asset protection, tax preparation, and succession planning.With an overseas trust fund, individuals and businesses can have higher control over their wealth and how it is taken care of. They can choose the jurisdiction where the trust is established, allowing them to take benefit of desirable regulations and guidelines. This flexibility allows them to maximize their tax position and shield their possessions from possible risks and responsibilities.

Additionally, overseas trusts provide the choice to assign expert trustees that have comprehensive experience in managing intricate trusts and navigating global regulations. This not only guarantees efficient wealth monitoring but also provides an added layer of oversight and safety.

In check my site addition to the flexibility and control provided by offshore trust funds, they additionally offer confidentiality. By holding possessions in an overseas jurisdiction, people and organizations can protect their financial info from prying eyes. This can be specifically useful for high-net-worth people and businesses that worth their privacy.

International Investment Opportunities

International diversification supplies individuals and companies with a wide range of investment chances to broaden their profiles and reduce threats. Investing in global markets permits financiers to access a bigger series of property classes, industries, and geographical areas that might not be offered locally. By diversifying their financial investments across various countries, investors can minimize their direct exposure to any type of single market or economy, hence spreading their threats.Among the vital benefits of international financial investment chances is the possibility for higher returns. Different countries may experience differing financial cycles, and by buying several markets, capitalists can maximize these cycles and possibly achieve greater returns contrasted to spending only in their home country. Additionally, spending internationally can also offer access to arising markets that have the possibility for rapid financial development and higher investment returns.

Moreover, international financial investment possibilities can offer a bush versus currency risk. When buying international money, capitalists have the prospective to benefit from money fluctuations. For example, if a financier's home money compromises against the currency of the foreign financial investment, the returns on the investment can be intensified when converted back to the capitalist's home currency.

Nevertheless, it is essential to keep in mind that investing globally also features its very own collection of risks. Political instability, regulative adjustments, and geopolitical unpredictabilities can all influence the efficiency of international financial investments. It is vital for investors to conduct detailed research and look for expert guidance before venturing into global financial investment possibilities.

Verdict

The fundamentals of overseas trust funds include the establishment and management of a trust in a territory outside of one's home country.Establishing an overseas count on typically requires engaging the solutions of an expert trustee or depend on business who is fluent in the legislations and regulations of the picked territory (offshore trustee). The trustee acts as the legal proprietor of the possessions held in the count on reference while managing them in accordance with the terms set out in the count on action. One of the vital benefits of overseas counts on is the capability to tailor the count on framework to satisfy certain demands and goals. Unlike conventional onshore trusts, offshore trusts provide a broad range of choices for property defense, tax preparation, and succession planning

Report this wiki page